The Complete Story of IPL’s Meteoric Rise

- Contributor - Bhavana Ramesh

- 20 min read

I : The Spark That Changed Cricket Forever

In 2007, cricket found itself at a crossroads.

Test matches sprawled over five days. One-Day Internationals still dominated television, but patience was wearing thin. A younger, faster India was taking shape , and the old rhythms of the game struggled to keep up.

Cricket wasn’t just a game to watch. It was about to become a game to experience.|

The Race Against Rivals

The Indian Premier League (IPL) was officially born.

And Modi had only months to build it from scratch.

Blueprint of a Revolution

Everything moved at breathtaking speed.

Modi, thinking like a founder rather than a bureaucrat, structured the IPL with a mix of sport, business, and spectacle. He opened team ownership to corporate giants, celebrities, and entrepreneurs.

The message was clear: this was bigger than cricket.

Build the teams right, and you don’t just sell cricket. You sell identity, loyalty, and dreams.

Opening Night: A New Era Begins

In 2008, the inaugural match delivered exactly what Modi had promised , and then some.

Brendon McCullum’s 158-run blitz electrified the crowd. Cheerleaders lined the boundary. Fireworks lit the night sky. Bollywood stars waved from the stands.

II: Cricket, Capital, and the Making of an Empire

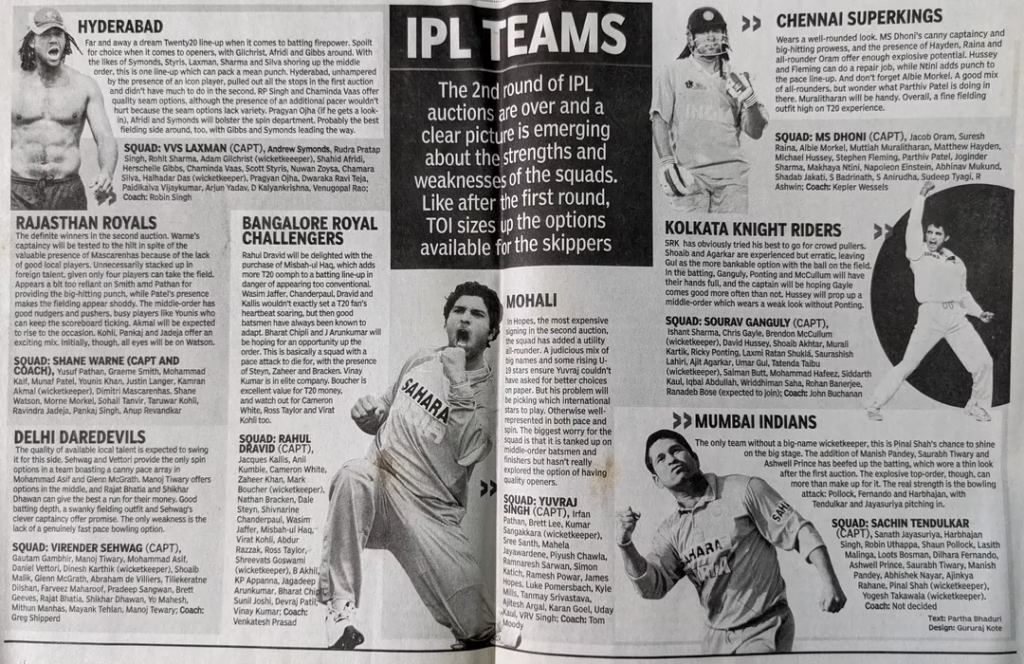

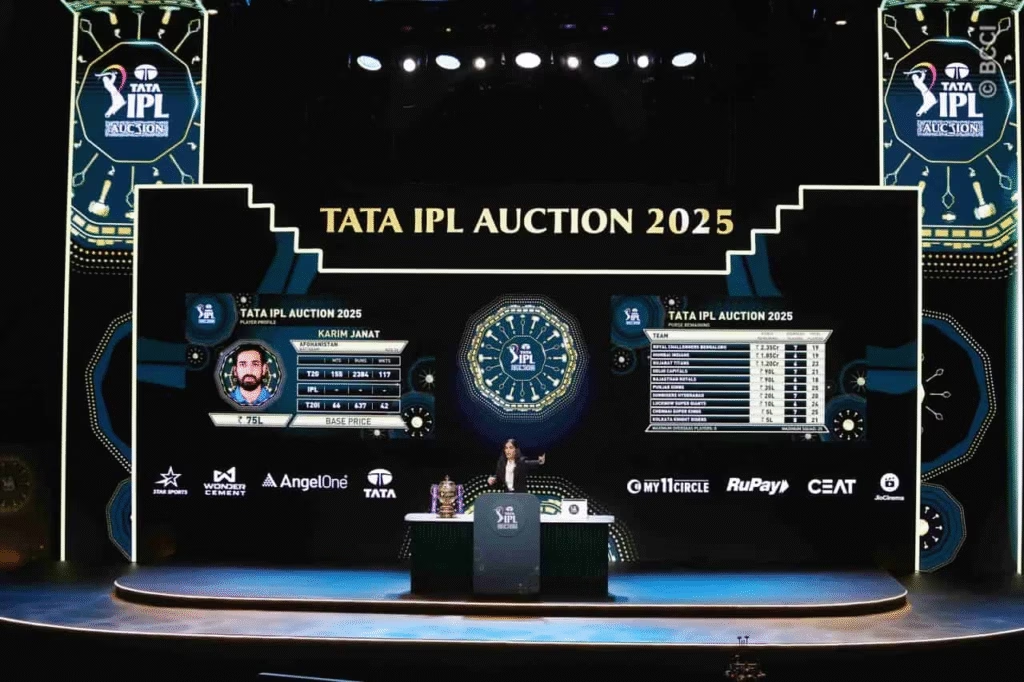

The Auction That Redefined Athletes

In the IPL, loyalty was measured in contracts, and fame could be won overnight.

The Rise of the Team Brands

Television: The Lifeline

When prime time becomes match time, you know the culture has shifted.

The Stadiums Become Stages

III: When the Big Money Showed Up

In 2010, the league added two new franchises: the Pune Warriors and Kochi Tuskers Kerala. The winning bids? $370 million combined.

At a time when the global economy was still licking its wounds from the financial crisis, the IPL had no such problems.

The message was clear: cricket wasn’t just surviving. It was scaling.

Storm Clouds: Scandals and Suspensions

By 2010, Modi was suspended by the BCCI.

The architect of the IPL was suddenly out of the very house he had built.

And yet, the IPL kept growing.

If anything, it got sharper. Cleaner. More professional.

New ownership groups, stricter governance, and a fresh set of eyes on league management set the stage for the next phase of expansion.

The Bidding War of 2021

- Sanjiv Goenka’s RPSG Group bought the Lucknow Super Giants for $950 million.

- CVC Capital Partners secured the Ahmedabad franchise (now Gujarat Titans) for $740 million.

Those numbers weren’t mistakes.

They represented almost 10x the original 2008 franchise valuations.

The IPL had officially crossed into billion-dollar territory and it wasn’t slowing down.

Payment Terms and Payouts

The setup wasn’t just fair.

It was a masterclass in keeping early stakeholders loyal while still expanding the pie.

And behind the scenes, the real accelerant was waiting: a brand-new media rights auction that would make the 2017 numbers look like small change.

The next phase was pure rocket fuel.

IV: The $6 Billion Broadcast Jackpot

- Domestic TV

- Domestic digital

- International TV

- International digital

A classic 2×2 matrix.

Separate bidders. Separate checkbooks. Bigger payday.

When you slice the pie right, you don't get a bigger slice. You get a whole second pie.

The Winners and the Numbers

- Disney Star (the incumbent) won the domestic TV rights.

Price: $3.02 billion for five seasons. - Viacom18 (a joint venture between Reliance and Paramount) stunned everyone by winning the digital rights.

Price: $3.05 billion — yes, digital topped TV for the first time.

Quick comparison:

2017 combined rights? $2.5 billion.

2022 domestic rights alone? $6.1 billion.

That’s 2.5x growth in just five years.

The Streaming Bet

You can’t be the king of streaming in India if you don’t have cricket.

- Hotstar lost millions of subscribers.

- Disney’s global streaming growth hit a wall.

International Rights: A Side Dish

- Australia, New Zealand, the UK, South Africa.

In other words:

- Indian rights = $6.1 billion

- Rest of the world combined = pocket change

Guaranteed Cash Flows

Add it all up:

- $1.25 billion per year from media rights.

- $150–200 million annually from central sponsorships.

- Nearly $1.5 billion flowing into the league every year — locked in for five years.

Asset-light. Guaranteed revenues.

No heavy stadium investments (yet).

Minimal player costs (compared to revenue).

On paper, the IPL was starting to look like the perfect private equity asset.

And the story wasn’t even close to peaking.

V: The Most Valuable Two Months in Sports

If you want to understand the IPL’s rise, strip it down to a simple stat:

The league plays 74 matches a year, yet it’s already second only to the NFL when you measure revenue per game.

Here’s the math:

- The IPL’s annual central revenue sits between $1.5–$1.6 billion.

- Divide that across 74 games, and you land at roughly $20–$22 million per match.

To put that in perspective, Major League Baseball drags itself through over 2,400 games a year, generating just $1.7 million per game. Meanwhile, the English Premier League, seen as a global powerhouse, averages around $15–$16 million per match. The NBA hovers at about $5 million per game.

Only the NFL blows everyone out of the water, pulling in an eye-watering $45–$49 million per game.

One night of IPL brings in more money than a full week of Major League Baseball.

The Operating Model: A Business School Case Study

Teams are structurally built for high-margin cash flows. Player salaries are capped at about $17 million per team. Franchises, for the most part, do not own their stadiums yet, which means they avoid the debt and maintenance nightmares that NFL or NBA teams endure. Stadium ownership may come later, but right now, the model is practically asset-light.

In simple terms:

- An average IPL team pulls in $70–$80 million in annual revenue after the BCCI’s cut.

- Their operating profits (EBITDA) are roughly $45–$55 million.

If you love SaaS economics, you should love IPL economics. It's SaaS, except the customers show up wearing face paint and beating drums.

The Scarcity Playbook

- The Mumbai Indians have been pegged at around $1.3–$1.4 billion.

- The Chennai Super Kings are in similar territory.

- The average team hovers close to the $1 billion mark.

That puts them toe-to-toe with legacy NBA franchises, and the kicker is that the IPL has accomplished this in just 16 years. A blink, compared to the half-century it took the NBA to climb into billion-dollar valuations.

Room Left to Run

This isn’t even the end of the road.

India’s total ad market is still about one-tenth the size of the U.S. Streaming monetization is still early. Smartphone usage is still expanding.

In other words, for investors and team owners already on the inside, this isn’t a mature, peaking asset.

It’s early innings, with a lot of upside still left to grab.

VI: IPL as an Empire – More Than a League, It’s Its Own Economy

At this point, calling the IPL a “sports league” feels quaint. It’s more accurate to think of it as an economy — an entire ecosystem buzzing with businesses, products, services, and millions of participants.

In India, cricket isn’t just a sport. It's a religion. And for two months every year, the IPL is the pilgrimage.

And this economy is built on three unstoppable forces:

Media Rights.

Expansion.

Untapped Markets.

The Bull Case: Why the IPL Could 10x Again

- $100 million per year in the early days.

- Now sitting at about $1.2–$1.3 billion per year.

If the league gradually adds:

- 2–4 more teams

- Extends the season to 10–12 weeks

- Adds a second mini-season or an international playoff window

The IPL's Growing Real Estate

Then there’s the physical world.

As stadium ownership and upgrades become more sophisticated, the IPL teams will follow the NFL playbook:

- Luxury suites

- Naming rights

- Premium seating licenses

- Retail and entertainment zones around stadiums

Right now, stadiums are state-owned or BCCI-managed, and IPL teams lease them. That keeps costs low, but it also caps potential upside. Once teams start investing in infrastructure — think Bollywood meets Jerry Jones’ AT&T Stadium — local revenues could easily rise from 15% to 30–35% of total revenues.

It would mean the IPL shifts from an events business to a real estate + media hybrid machine.

The Megabull Case: Global Expansion

If you really want to stretch the imagination, here’s the wildest possibility:

The IPL becomes India’s first true global consumer export.

Imagine:

- IPL matches staged in New York, London, Dubai, Singapore

- American and British investors buying stakes in new expansion teams

- Bollywood stars hosting halftime shows in Yankee Stadium

Reality Check: It’s Still a Heavy Lift

Now, nobody’s pretending this is automatic.

India’s media environment is changing fast. Consolidations like Disney-Star and Viacom18 merging reduce the number of bidders for broadcast rights. Streaming monetization is still shaky compared to traditional TV. And while the IPL owns India, growing globally would mean fighting time zones, unfamiliarity, and entrenched sports habits.

When you have the golden goose, you don't cut it open to look for more eggs. You feed it carefully, and you let it grow fat.

Bottom Line

Today, the IPL looks like a once-in-a-generation asset.

- It rides on the back of India’s growing middle class.

- It captures attention with unmatched entertainment value.

- It throws off cash at startup-like growth rates but with luxury brand margins.

VII: The Bear Case – Where the IPL’s Dream Could Hit Reality

It has been all fireworks and billion-dollar deals so far, but the IPL is not invincible. Every empire faces its pressure points, and the IPL is no exception. Underneath the booming numbers, there are cracks that could widen if the league is not careful.

1. India’s Business Environment: Growing, but Uneven

A world-class league needs world-class reliability behind the scenes.

2. Media Market Shrinking: Fewer Bidders, Lower Bids

3. Streaming Monetization: The Big Bet That Still Has to Pay Off

The reality is tougher.

- Mobile data in India remains the cheapest in the world.

- Subscription fatigue is real.

- Advertisers are still cautious when it comes to digital spending.

4. Players Could Demand a Bigger Slice

5. Expansion: Growth Could Weaken the Core

The IPL’s magic was built on concentrated excitement.

If the league turns into a year-round grind, it risks becoming just another cricket league rather than the phenomenon it is today.

The IPL was a miracle of focus. Lose that focus, and you lose the magic.

The Bottom Line

The IPL has climbed to rare heights.

It has the momentum, the money, and the market. But growth brings new risks.

If the BCCI and the owners start taking the good times for granted, if the hunger and discipline that built the IPL soften, cracks will widen.

No competitor is going to bring the IPL down.

The real danger will come from inside the house.

VIII: The IPL Experience: A Stadium, A Spectacle, A Social Shift

IX: Designing the Spectacle – How the IPL Rewired Spectator Experience

And it all points to a bigger truth: experience is the product. Cricket gave the IPL its structure. Design gave it a soul.

X: From the Stands to the Studio – Designing for the Game, with the Game

This is where Bang Design has played a part.

Moonwalkr: Designing the Future of Player Protection

Moonwalkr came to us with a bold ambition: to reimagine cricket safety gear so it could actually keep up with the game. Traditional equipment had stayed stuck in the past. It was rigid, bulky, and lacking in performance cues. For a game that had evolved into high-velocity entertainment, the gear hadn’t kept pace.

To see how we combined form, function, and identity into a single narrative, explore the full Moonwalkr case study.

Freebowler: Making Professional Practice Portable

Freebowler started with a simple challenge: how do you give aspiring players access to high-quality practice without needing a stadium, an electric ball machine, or a coaching crew? Their early prototype of a manual bowling machine held potential, but needed refinement. It needed to be rugged, portable, and easy to use—even in backyard settings.

What We Offer to the Sports and Performance Sector

For sports clients, our services typically include:

- Product Design and Engineering: Full-cycle support from concept sketches to CAD to tooling and production, customized for athletic use.

- Brand Identity and Positioning: Strategy and creative direction that helps emerging brands punch above their weight in competitive markets.

- UX and UI for Fan and Athlete Platforms: Designing interfaces for player dashboards, streaming tools, or app-based coaching systems.

- Packaging, Retail Displays, and Visual Merchandising: Physical brand touchpoints that extend the impact of the product.

- Marketing and Launch Collateral: Investor decks, explainer videos, digital campaigns, and web content that prepare the product for market.

Learn more about how we work on our Services page or dive into more of our case studies to see our impact across industries.

Designing the Culture Around the Game

At Bang Design, we believe design is a force that shapes behavior, defines brands, and unlocks new business models. Whether it’s helping a startup bring a training innovation to life, or building a global-ready sports brand from scratch, we’ve done it—and we’re doing more of it every year. If you’re working at the edges of sport, product, or fandom and need a design partner who understands performance, scale, and storytelling, reach out to us. We’re always ready to build what’s next.

Subscribe now to get started

Get unlimited access to: